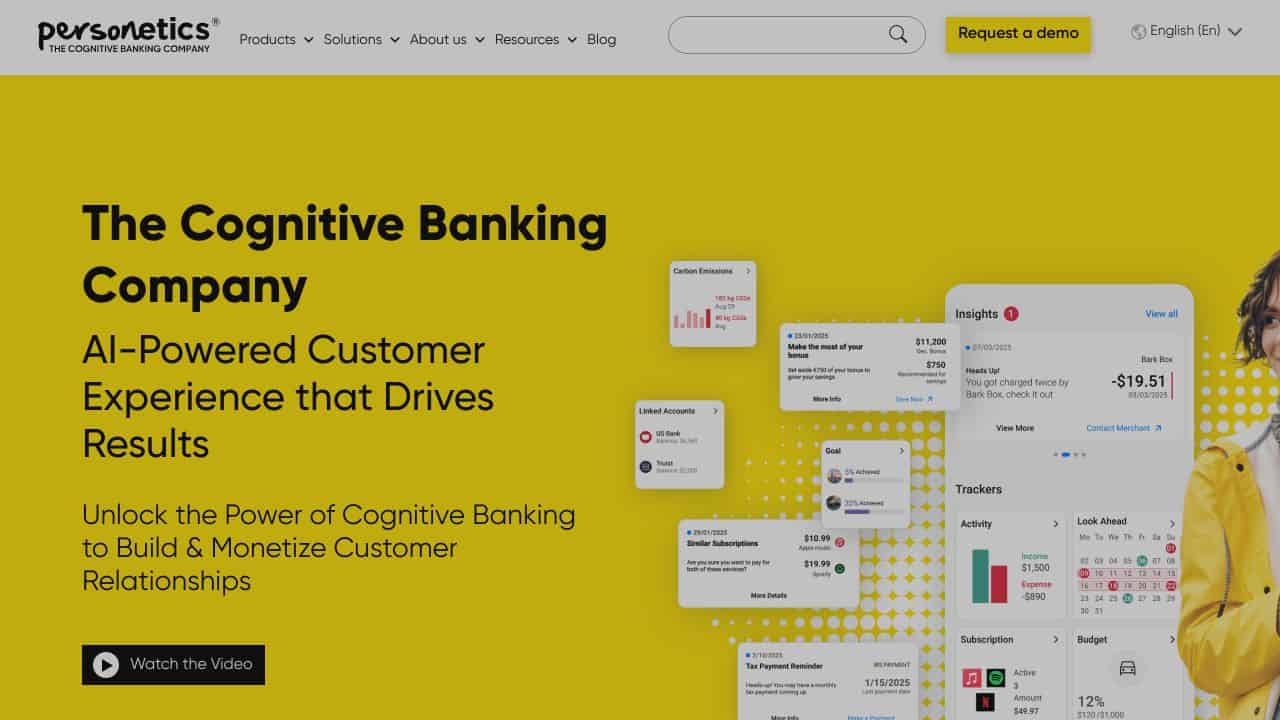

What is Personetics

Personetics is a cutting-edge AI-driven platform designed to enhance digital banking experiences. It empowers banks and financial institutions by providing personalized insights and actionable advice to customers. With a reach of over 150 million banking customers across 30 global markets, Personetics simplifies complex financial data, enabling better money management and smarter financial decision-making.

Personetics Features

- Advanced AI and Machine Learning: Utilizes sophisticated algorithms to analyze financial transactions and user behaviors, offering tailored financial guidance.

- Data Enrichment & Categorization: Transforms raw transaction data into meaningful insights, making it easier for users to understand their financial activities.

- Engagement Builder: Allows institutions to create custom insights without coding, thanks to its intuitive admin console.

- Proactive Financial Insights: Delivers automated financial advice and predictions to help users optimize their financial health.

Personetics Usecases

Personetics can be utilized in various scenarios, making it a versatile tool for different users:

- Major Banks: Enhance customer relationships by providing personalized banking advice.

- Credit Unions: Improve member services with tailored financial insights.

- Digital Banks: Automate and personalize customer interactions using AI.

- Financial Advisors: Leverage insights to offer better advice to clients.

- Educational Institutions: Teach students about real-world financial management through simulations.

Conclusion

In summary, Personetics stands out as a transformative tool in the banking sector, offering advanced AI-driven financial insights and personalized money management solutions. Its unique Self-Driving Finance feature simplifies financial management, empowering users to achieve their financial goals autonomously. Whether you’re a large bank or a small credit union, Personetics provides scalable solutions that enhance customer satisfaction and drive financial health.